With the recent election giving Republicans control over the White House, the House of Representatives, and the Senate, a reinvigorated conversation is brewing over entitlement reforms, specifically Medicare. As you share Thanksgiving dinner with family and friends, a quick look around the table will likely reveal a few loved ones that rely on the Medicare program. More than 57 million Americans depend on Medicare to help pay the costs of medical bills. For years, Republicans have proposed reforming Medicare by replacing it with premium support (AKA, vouchers). We’ll talk more about that later. Let’s start by teasing out Speaker Paul Ryan’s claims for why Medicare needs reforming.

Days after the election, on Fox news, Ryan said, “Well, you have to remember, when Obamacare became Obamacare, Obamacare rewrote Medicare, rewrote Medicaid, so if you are going to repeal and replace Obamacare, you have to address those issues as well.” He summarized “What people don’t realize is because of Obamacare, Medicare is going broke.” This is false. The Washington Post fact checker recently gave this statement four Pinocchios, and here is why.

Is Medicare Going Broke?

First, let’s get a little better understanding of Medicare. Medicare is a four-part program: Part A Hospital Insurance, Part B Physician Insurance, Part C Medicare Advantage, and Part D Prescription Drug Coverage. Medicare Parts A and B along with Medicaid were assembled by Representative Wilbur Mills back in 1965 to make up the three-layer cake legislation which changed the health care landscape as we know it. In 2003, the Medicare Prescription Drug, Improvement, and Modernization Act (MMA) renamed Medicare’s private plans as Medicare Advantage under Part C and established outpatient prescription drug coverage through Part D.

When politicians and health policy wonks talk about Medicare “going broke” or concerns around “solvency” of the Medicare program, they are just talking about Medicare Part A. Part A covers Hospital Insurance (i.e., inpatient stays in the hospital, hospice care, and post-acute skilled nursing facility care) and is financed by a 2.9 percent payroll tax split by employers and employees that goes directly into the Hospital Insurance Trust Fund. This is the “pay as you go” part of the Medicare program, where current workers are paying for current Medicare beneficiaries. This is the fund that we continually evaluate for insolvency, or as described in a recent report on Medicare: Insolvency Projections by the Congressional Research Service:

As long as the HI Trust Fund has a balance (i.e., securities are credited to the fund), the Treasury Department is authorized to make payments for Medicare Part A services. If the HI Trust Fund is not able to pay all current expenses out of current income and accumulated trust fund assets, the HI Trust Fund is considered to be insolvent. (p. 7)

So no, the Medicare program as a whole is not going broke. Now, on to the second claim.

Did Obamacare Negatively Impact Current Solvency Projections?

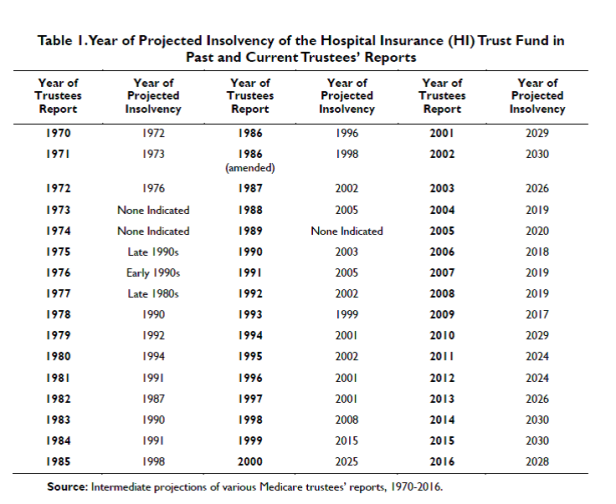

Obamacare actually increased payments into this fund, as the payroll tax was raised 0.9 percent for higher income workers—individuals above $200,000 and married above $250,000. In fact, in 2010, the same year Obamacare was signed into law, the projected insolvency of the Hospital Insurance Trust Fund increased significantly. Specifically, in 2009 the year of projected insolvency was 2017, while in 2010, the year of projected insolvency was 2029. See for yourself, in this report from the Congressional Research Service published in October 2016 (Table 1 below).

Based on 2016 estimates, the Hospital Insurance Trust Fund would be depleted in 2028, but as the recent fact check by Glenn Kessler from the Washington Post explains:

Although the Part A trust fund would be “depleted,” it would not be “penniless” or “broke.” That is because the government could still cover 87 percent of estimated expenses in 2028 — and 79 percent in 2040. So, yes, there would be a shortfall, but it doesn’t mean Medicare would be bankrupt.

You likely also notice fluctuations in the projected years of insolvency between 2010 and 2016. The CRS report explains how the downward trend is in part due to lower payroll tax contributions from higher than expected unemployment and slower wage growth in the early years, while the renewed upward trend in insolvency projections more recently stems from lower than expected utilization and spending on Part A services. And again, all these conversations about insolvency are just talking about paying for Medicare Part A, hospital insurance. Hence, four Pinocchios.

What Would A Republican Led Medicare Overhaul Look Like?

So, while Speaker Ryan’s reasons for reform may not hold water, his resolve still stands. Understanding how his plan will change Medicare as we know it requires a full understanding of the basic structures of Medicare. When beneficiaries sign up for Medicare, they choose to enroll in either “original Medicare” (often called traditional Medicare, a reference to Parts A and B as the origins of the Medicare program) or a Medicare Advantage plan through Part C administered by private health plans, much like your employer sponsored insurance HMO or PPO. Beneficiaries can choose to enroll in Part D (prescription drug coverage) alongside traditional Medicare. Typically, Medicare Advantage Plans include prescription drug plans as part of their package. As of September 2016, nearly 67 percent of Medicare beneficiaries were enrolled in traditional Medicare.

So, what does this actually mean? Ryan’s A Better Way plan (starting on p. 30) explains how traditional Medicare (Parts A and B) would be combined and replaced by premium support (see the summary recommendations below, p. 31):

Note the rhetoric, “preserving Medicare for future generations.” This is the meat of the privatization proposal. The plan reads, “The final step to save the program is transforming the benefit into a fully competitive market-based model—known as premium support” (p. 36). Moving to a “premium support” plan is the same concept as the shift from pensions (a defined benefit) to 401Ks (a defined contribution). Applied to Medicare, instead of the federal government providing direct insurance coverage through Parts A and B, Medicare beneficiaries would receive a payment from the federal government on their behalf toward the purchase of a private health insurance plan. In other words, your Grandmother’s Medicare program would become a voucher for private health insurance, in many ways similar to the premium tax credits offered through the Health Insurance Exchanges as part of Obamacare.

In Ryan’s plan he explicitly states “This is not a voucher program.” Voucher programs are often criticized for their inability to cover the full cost of health insurance plans for beneficiaries. Yet, just sentences before he suggests “Medicare would provide a premium support payment either to pay for or offset the premium of the plan chosen by the beneficiary, depending on the plan’s cost” (p. 36, emphasis added). Not surprisingly, the devil is in the details here, as the potential impact on beneficiary cost sharing, access to care, and overall Medicare costs varies dependent on the specific design. Details aside, this would be a major change in the operation of the Medicare program. The plan does note this new program would not impact current Medicare beneficiaries or those nearing retirement, instead allowing these “grandfathered individuals” the choice to enroll in these new plans.

Will Republicans Try to End Medicare as We Know It?

Many people are weighing in on the will they or won’t they debate. For example, Ed Kilgore’s recent piece in New York Magazine outlines some of this back and forth:

- Yes, they’ll do it because there’s no time like the present.

- No, they won’t do it because they have bigger fish to fry.

- Yes, they will do it because they need the budget savings to pay for their other stuff.

- No, they won’t do it because it directly hits Republican constituents and violates Republican promises to them.

- No, they won’t do it because you can’t restructure a whole program using a budget-reconciliation bill.

- Yes, they will do it, because they make the rules.

- It’s also possible Republicans could decide not to do it now but to do it later.

Moreover, Paul Waldman argues on the Washington Post Plum Line Blog, that this fight will unite Democrats, and ultimately fail. Similarly, Nancy Altman on the Huffington Post blog suggests that Democrats should propose a Medicare-for-All bill as the replacement for Obamacare and stand firm in opposition.

On the other hand, Josh Marshall from Talking Points Memo suggests that overhauling Medicare could be more likely than repealing Obamacare. While this suggests that the move to privatize Medicare is highly likely, it may instead be an emphasis on the infeasibility of repealing Obamacare (see recent SPFHealth Blog post on the fate of the ACA) in part because of the potential backlash of eliminating insurance coverage for millions of people, and the implementation challenges related to keeping only parts of the private insurance reforms in Obamacare.

Lastly, it’s hard to tell where President Elect Trump falls on the issue. While candidate Trump made no mention of Medicare in his health reform platform, since becoming President Elect Trump, he has added to his Administration’s health care platform a plan to “Modernize Medicare, so that it will be ready for the challenges with the coming retirement of the Baby Boom generation – and beyond.” This sounds like he might be talking to Speaker Ryan about the broader Republican agenda. So, while on the lookout for an Obamacare overhaul, keep an eye on Medicare as well.

Thanks Signe! This is the first comprehensive discussion I’ve seen

LikeLike